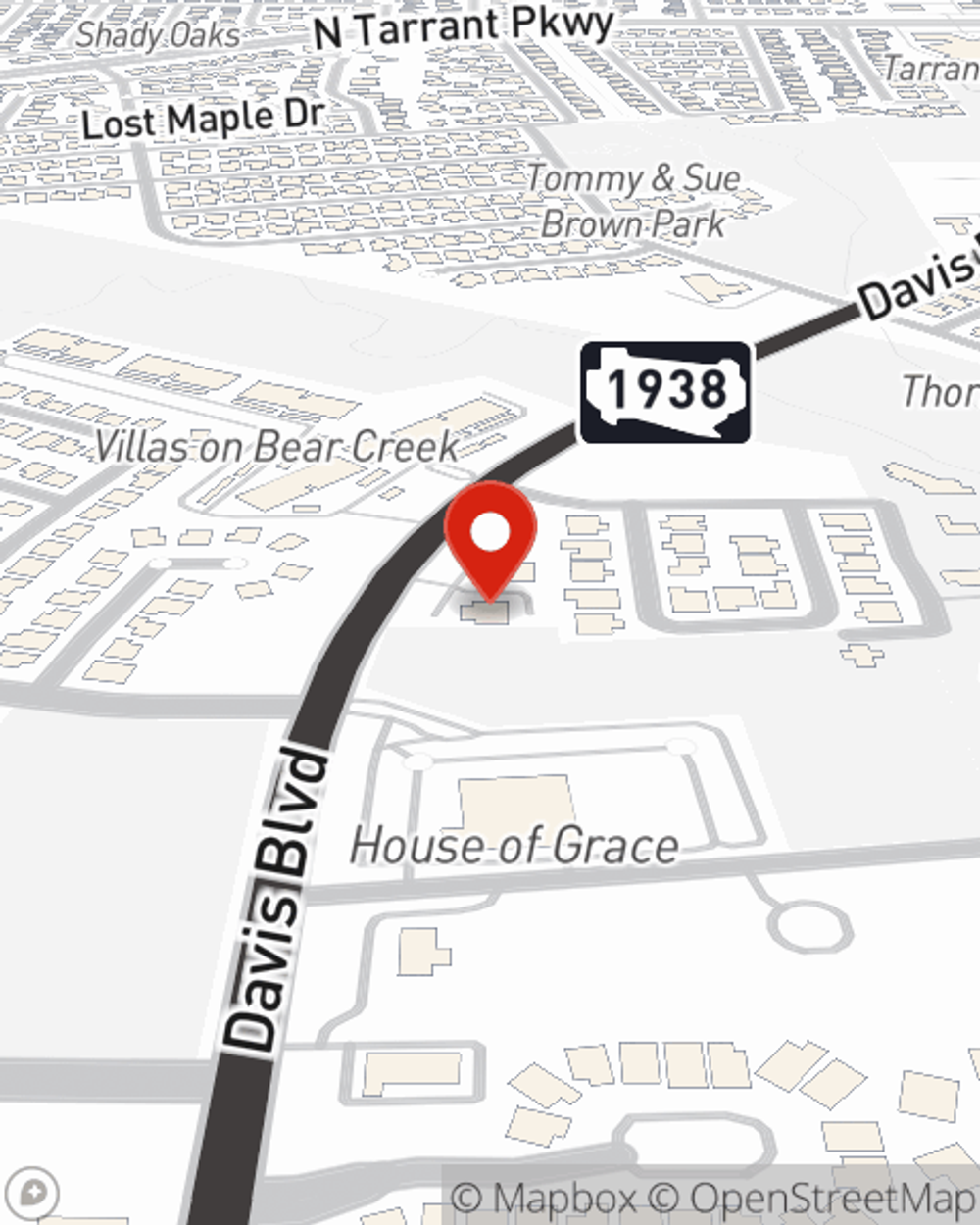

Business Insurance in and around North Richland Hills

Researching coverage for your business? Search no further than State Farm agent Laura Geninatti!

Cover all the bases for your small business

- North Richland Hills

- Hurst

- Bedford

- Euless

- Keller

- Colleyville

- Southlake

- Fort Worth

- Grapevine

- Westlake

Coverage With State Farm Can Help Your Small Business.

You've put a lot of time into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a hair salon, a clock shop, a HVAC company, or other.

Researching coverage for your business? Search no further than State Farm agent Laura Geninatti!

Cover all the bases for your small business

Keep Your Business Secure

When one is as committed to their small business as you are, it is understandable to want to make sure everything has been thought of. That's why State Farm has coverage options for surety and fidelity bonds, commercial auto, commercial liability umbrella policies, and more.

As a small business owner as well, agent Laura Geninatti understands that there is a lot on your plate. Get in touch with Laura Geninatti today to get more information on your options.

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Laura Geninatti

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.